Investment Planning – A Disciplined Approach to Your Financial Goals

Investment planning is a process designed to align your current resources with your long-term objectives. For small business owners, self-employed professionals, and high-income earners, a structured plan can help manage risk, pursue growth, and support financial goals over time.

At Correct Capital Wealth Management, our fiduciary advisors develop personalized strategies intended to help clients work toward their objectives while considering tax efficiency and adapting to changing circumstances. Whether your priorities include retirement planning, stabilizing income, or building long-term wealth, we focus on creating plans that reflect your goals and risk tolerance.

Give us a call at (877) 930-4015, contact us online, or schedule a meeting to start building your investment plan with a financial advisor who puts your interests first.

Why Investment Planning Matters Now

Markets fluctuate. Inflation can rise. Business income may change. While goals such as financial independence and security often remain constant, achieving them requires a plan that adapts to evolving conditions. Without a structured approach, investors may react emotionally to short-term market movements rather than following a long-term strategy.

Investment planning can help reduce the likelihood of making impulsive decisions during volatility and encourage disciplined investing during periods of growth. It is designed to align your investment approach with your objectives, recognizing that all investing involves risk, including the potential loss of principal.

What Is Investment Planning?

Investment planning is the process of aligning your current financial resources with your future objectives. These objectives may include retirement, purchasing property, or funding education.

A thoughtful investment plan begins with understanding your financial position, clarifying priorities, and building a diversified portfolio that reflects both your goals and your tolerance for risk. Rather than reacting to headlines, you follow a long-term strategy intended to manage risk and pursue growth over time.

Key Components of Investment Planning

- Define your goals: Identify short- and long-term priorities, such as education funding or retirement.

- Assess your current situation: Review income, expenses, assets, and liabilities to understand your investing capacity.

- Determine your risk tolerance: Comfort with volatility varies by age, time horizon, and financial circumstances.

- Create a portfolio: Diversify across asset classes—such as stocks, bonds, and mutual funds—to help manage risk.

- Develop a strategy: Many investors formalize their approach in an Investment Policy Statement (IPS) to encourage discipline.

- Monitor and adjust: Review your plan regularly to ensure alignment with changing goals and market conditions.

Once we understand your goals and comfort with risk, Correct Capital can develop a personalized strategy designed for long-term success.

How Investment Planning Fits Into Your Broader Financial Picture

Investment planning interacts with other areas of your financial life:

- Tax strategy: Consider tax implications of gains, dividends, and withdrawals.

- Retirement planning: Align investments with your desired lifestyle and timeline.

- Business planning: Investments can supplement or diversify business value.

- Estate and legacy planning: Investments may support education, philanthropy, or wealth transfer.

Correct Capital’s financial advisors work with our clients to develop a holistic financial strategy. Tell us your goals, and we’ll build the roadmap to reach them.

Our Investment Planning Process

Every plan begins with a conversation about your goals, business structure, and what successful investing looks like to you. From there, we apply a disciplined process:

- Understanding Your Financial Landscape

We review income, assets, liabilities, and savings to establish a strong foundation. - Setting Purpose-Driven Goals

Each goal—retirement, business growth, property purchase—receives a tailored approach. - Aligning Risk and Reward

We help you select an allocation that reflects your comfort with volatility and long-term objectives. - Building a Diversified Portfolio

Diversification across asset classes, sectors, and regions helps manage risk. - Selecting the Right Accounts

Account types—such as retirement plans, brokerage accounts, and savings vehicles—are chosen based on goals and tax considerations. - Ongoing Management and Rebalancing

Your portfolio may shift over time due to market movements and changes in your goals. We offer periodic reviews and, when appropriate, rebalancing to help keep your allocation aligned with your stated investment strategy. This process is intended to maintain consistency with your objectives, but it does not eliminate risk or guarantee performance.

The objective is to help reduce the impact of market volatility and promote more consistent performance over time.

How We Use the Bucket System

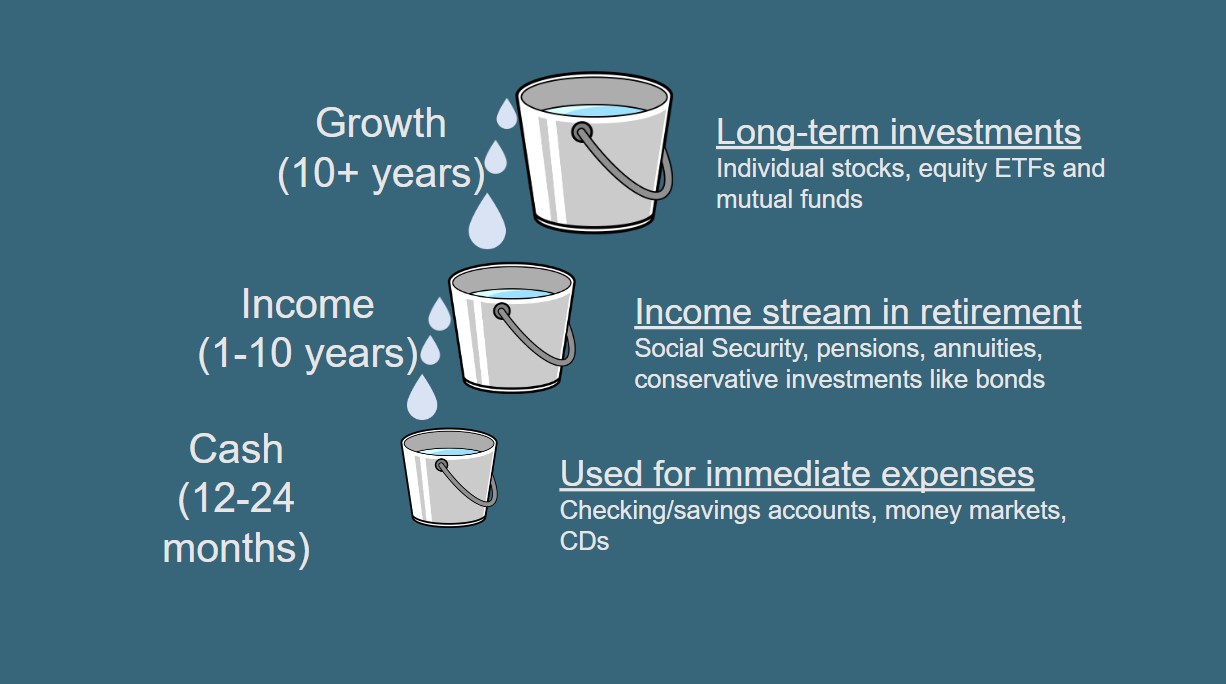

We often organize investments into three “buckets” based on time horizon and purpose:

- Cash Bucket (12–24 Months): For immediate expenses like mortgage payments, business costs, or travel; typically includes checking, savings, and short-term CDs.

- Income Bucket (1–10 Years): Designed to provide a steady stream of income that can be used to replenish the Cash Bucket as needed; may include bonds and conservative funds.

- Growth Bucket (10+ Years): The third bucket is intended to focus on long-term growth and help offset the effects of inflation over time; typically includes equities and diversified funds.

By allowing this bucket to remain invested over time, the goal is to support long-term growth while the other buckets are intended to address shorter-term needs and help manage market volatility. It does not eliminate risk, and allocations should be reviewed regularly.

Common Investment Planning Mistakes

We help clients avoid common pitfalls, such as:

- Chasing performance: Buying what’s hot and selling what’s not often backfires.

- Ignoring taxes: Overlooking tax implications can reduce returns.

- Overconcentration: Too much in one stock or sector increases risk.

- Skipping rebalancing: Market shifts can throw off your strategy.

- Panic selling: Emotional decisions during volatility can derail long-term plans.

A thoughtful investment plan, supported by guidance from a qualified financial advisor, can help you avoid common mistakes and stay focused on your long-term goals

Why Clients Choose Correct Capital

- Fiduciary commitment: Our obligation is to act in your best interest at all times.

- Independent advice: No proprietary product requirements.

- Collaborative process: You remain informed and involved.

- Long-term relationships: We support you through life’s transitions.

Everything we do is based on our I.O.U. Promise: independent, objective, and unbiased advice.

Start Your Investment Planning Today

Your investment strategy should reflect your goals, values, and vision for the future. Whether you’re growing a business, managing a professional practice, or preparing for retirement, our fiduciary advisors can help you develop a plan that aligns with your objectives and risk tolerance—so you can approach the future with confidence.

Give us a call at (877) 930-4015, contact us online, or schedule a meeting with a member of our advisory team to start your personalized investment plan today.

Important Disclosures

This material is provided for informational and educational purposes only and should not be construed as personalized investment advice or a recommendation to buy or sell any security. The Bucket Approach is a conceptual framework and does not guarantee performance or eliminate market risk. Individual circumstances vary, and strategies should be tailored to your specific goals, risk tolerance, and financial situation. All investments involve risk, including the possible loss of principal. Past performance is not indicative of future results.

Correct Capital Wealth Management is a registered investment adviser. Registration does not imply any level of skill or training. For more information about our services and disclosures, please review our Form ADV and other regulatory filings at https://www.sec.go.